TULSA, Okla. — "I thing sometimes they don't realize how much things cost," said Junior Achievement of Oklahoma COO, Erica Irvine.

It's one of the reasons Junior Achievement is offering free online lessons to help kids from kindergarten through high school learn about money — and what it takes to earn it.

There are basic lessons for the littlest kids.

"Like coin recognition and understanding how you add money together," said Irvine.

Older students learn about financial life lessons.

"Things like budgeting," said Irvine. "And understanding what it means when you look at your paycheck and there's a piece taken out for taxes and Social Security and those kinds of things."

She adds that there are also lessons about understanding what credit is and how to use it wisely.

There are even lessons about the risks gambling poses to your financial health.

Kids can also learn about what it takes to become an entrepreneur by exploring the ins and outs of:

- funding a start-up

- pitching business ideas

- protecting intellectual property

- defining the "why" of your business

- strategies that can help anyone start a business

There are also practical lesson for:

- managing money

- planning for your financial future

- and making your money work for you.

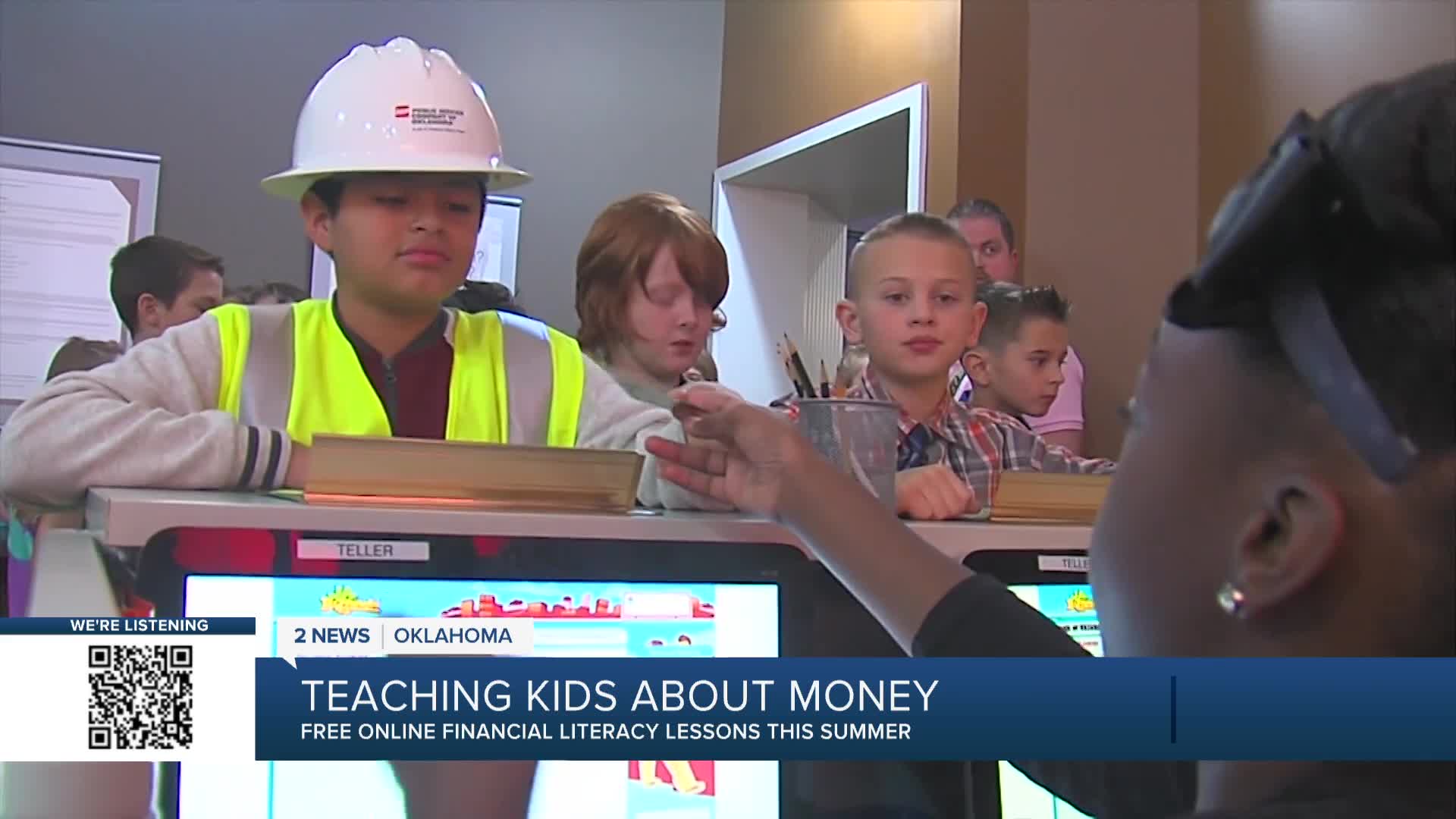

These are some of the lessons that up to 11,000 students a year also learn during trips to the Junior Achievement of Oklahoma BizTown in Tulsa.

It provides students with hands-on learning about business and personal financial basics by assigning each to a job.

"They learn what it's like to work in a business and earn a paycheck."

"I learned how to write a check," said Carolyn Chen.

Students going through both the in-person and online lessons often have an "ah-ha" moment as they discover money is a tool and that it takes a lot of it to pay household bills.

WATCH: Free online Junior Achievement lessons help kids learn the value of money

"We'll have kids say.I had no idea groceries cost this much," said Irvine, "And as we all know, groceries are costing more and more these days. We also hear things like I didn't realize that childcare would cost so much and so they need to understand that if they make a choice to have a child, then they need to be able to pay for that childcare.

But it's not just food and childcare that can be expensive.

"I'm saving for a new flute," Chen said. It's going to cost about $3,000 so she told 2 News she's glad she learned an important lesson.

"Save up now for things in the future."

Stay in touch with us anytime, anywhere --

- Download our free app for Apple, Android and Kindle devices.

- Sign up for daily newsletters emailed to you

- Like us on Facebook

- Follow us on Instagram

- Watch LIVE 24/7 on YouTube